Opening an SDIRA can provide you with usage of investments Usually unavailable through a financial institution or brokerage organization. In this article’s how to start:

And since some SDIRAs which include self-directed conventional IRAs are subject matter to demanded minimal distributions (RMDs), you’ll ought to strategy ahead making sure that you have adequate liquidity to satisfy The principles set with the IRS.

Better Service fees: SDIRAs often come with higher administrative expenses in comparison with other IRAs, as specified facets of the executive method can't be automated.

Complexity and Obligation: With an SDIRA, you've got far more Regulate around your investments, but you also bear more responsibility.

The tax positive aspects are what make SDIRAs beautiful For numerous. An SDIRA is often both of those regular or Roth - the account sort you decide on will rely mostly on your own investment and tax system. Verify along with your fiscal advisor or tax advisor when you’re Doubtful which happens to be most effective for you.

Due Diligence: It really is referred to as "self-directed" for your purpose. Having an SDIRA, you will be totally liable for thoroughly investigating and vetting investments.

Imagine your Good friend may be starting off the next Facebook or Uber? Having an SDIRA, you'll be able to spend money on leads to that you think in; and most likely appreciate increased returns.

Yes, real estate is among our shoppers’ most popular investments, at times referred to as a real-estate IRA. Consumers have the choice to take a position in everything from rental Homes, professional property, undeveloped land, home finance loan notes plus much more.

As an investor, however, your choices usually are not restricted to shares and bonds if you choose to self-direct your retirement accounts. That’s why an SDIRA can renovate your portfolio.

Due to this fact, they tend not to advertise self-directed IRAs, which offer the pliability to take a position within a broader selection of assets.

Regardless of whether you’re here a economic advisor, investment issuer, or other monetary professional, explore how SDIRAs can become a strong asset to improve your enterprise and attain your Specialist goals.

Buyer Assist: Seek out a supplier that offers focused guidance, like entry to knowledgeable specialists who will reply questions find out this here on compliance and IRS procedures.

Property is among the preferred options among the SDIRA holders. That’s due to the fact it is possible to put money into any sort of real estate property by using a self-directed IRA.

The most crucial SDIRA rules from the IRS that buyers have to have to comprehend are investment restrictions, disqualified folks, and prohibited transactions. Account holders ought to abide by SDIRA regulations and rules as a way to preserve the tax-advantaged standing of their account.

No, You can't spend money see this website on your individual enterprise which has a self-directed IRA. The IRS prohibits any transactions among your IRA and also your personal organization as you, because the owner, are deemed a disqualified man or woman.

Array of Investment Alternatives: Ensure the service provider will allow the categories of alternative investments you’re keen on, for instance real estate, precious metals, or private fairness.

Greater investment alternatives indicates you are able to diversify your portfolio over and above shares, bonds, and mutual money and hedge your portfolio versus sector fluctuations and volatility.

Numerous investors are amazed to learn that utilizing retirement money to invest in alternative assets has become probable because 1974. Even so, most brokerage firms and financial institutions target presenting publicly traded securities, like stocks and bonds, mainly because they absence the infrastructure and abilities to control privately held assets, such as property or non-public fairness.

IRAs held at banking institutions and brokerage firms present restricted investment options to their clients as they do not need the experience or infrastructure to administer alternative assets.

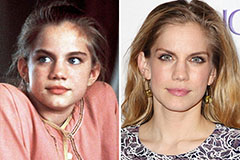

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now!